At the end of March 2019, it became known that the White House is pressuring the Fed to lower its benchmark federal-funds rate by half a percentage point, according to an article in the Wall Street Journal by Nick Timiraos and Kate Davidson. There has been no movement yet.

We now see homeowner rates for mortgages at the 4.1% range; some of the lowest in history. If the White House succeeds, the benchmark federal-funds will not translate to lower mortgage rates right away, but mortgage rates will inevitably drop. Possibly even lower than at any time during the past decade. It is a waiting game and time will tell over the coming months.

This would likely create more buyers, push prices higher in most markets, and create an upward push in strong economy cities (and even not-so-strong).

The magical 30-year fixed rate loan

Since we are aware of the uniquely special anomaly called the 30-year fixed rate loan, (we are the only country that has this type of loan) where neither the monthly PI (principal and interest) payment (not the loan balance) keep up with inflation and the super low rate will be locked for 30 years, we are fully protected.

If you qualify for the best loan, under the FNMA (Fannie Mae, officially the Federal National Mortgage Association, or FNMA is a government-sponsored enterprise (GSE)—that is, a publicly-traded company which operates under Congressional charter—that serves to stimulate homeownership and expand the liquidity of mortgage money by creating a secondary market.) guidelines this is a great time to buy where the numbers make sense. Taking action is important.

Many are not aware that they can purchase up to 10 homes with this type of loan. Married couples (if they qualify separately) can purchase 20. This is already a great time to lock these rates in with the magical 30-year fixed rate loan. If the White House succeeds in lowering rates, the terms will become more attractive.

In my experience, I have seen people look back and lament over not making use of these great circumstances to build a solid portfolio for their future. I hope you are not one of them.

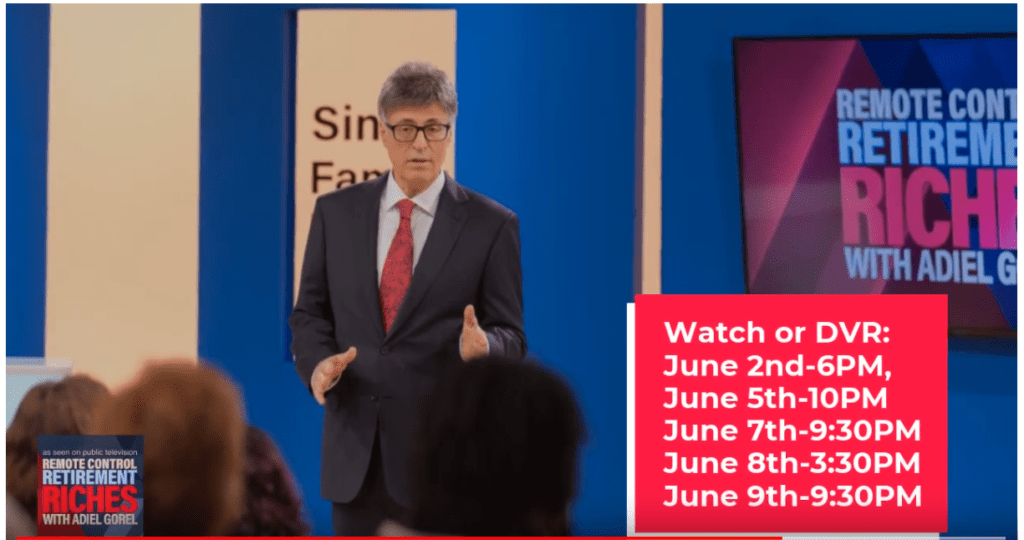

This summer in our Membership area we will have a couple of podcasts where I will talk about this solo and in interviews with experts. I will also be talking about the 30-year fixed rate loan in detail in my show produced for public television called “Remote Control Retirement Riches with Adiel Gorel” that will be airing over the next several days across the country. Take a look at our website here for details and to check for showtimes in your area.

Here is a recent video on the show currently posted on my YouTube channel: https://youtu.be/8eiUYcsOPiQ